Hoping to rope in more investors, Merlin Entertainment, a theme park service provider, announced its first Madame Tussauds franchise.

But contradicting the hope, critics at the HSBC double downgraded it as the shares tripped by 6.7% or 25.1 points to a level of 350 points.

Prague is all set to host the first ever Tussauds franchise this year. Asia and America are already the brand endorsers of this waxworks along with the acclaimed London attraction. However, Wax Museum in Prague is the very first instance Merlin will let another business run on its name.

The main objective of the company is to expand its businesses without investing a lot into buying properties and hiring employers. But analysts at the HSBC were diffident as they carved their recommendations from ‘buy’ to ‘reduce’ on the Merlin’s stocks. The growth calculations of Merlin did not impress the analysts who further reported that the elemental performance of the company had been lethargic.

In a note to clients, HSBC said: ‘Merlin isn’t a bad business, but we do think it’s overvalued’. In addition to this, they stated that they had no particular reason as to why the shares of Merlin should be ranked more than other entertainment organisations such as Carnival and Cineworld.

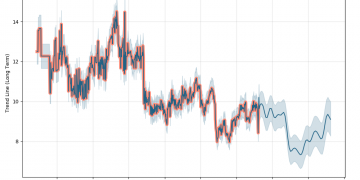

After a dull run since its listing in the stock market since last October, Aston Martin, the luxury automaker, is beginning to soar up again.

US based firm Bernstein helped in the rise of the stock by predicting that it might surpass the market substantially. Max Warburton of Bernstein stated that in January things weren’t as good and he contemplated there is a possibility of a profit caution approaching soon.

Aston Martin closed at 3.7% or 32.4 points up to 902.4 points which is not even half of the actual listing price of 1900p.

DBX, the first luxury SUV is set to release before June, next year. Max commented on the timing being a crucial factor here and warned that if gets delayed by 6 months, things could get craggy.

There was a downfall in the shares of Metro Bank by 3.1% or 21p closed at 656p. The ISS, Glass Lewis and Pirc, all the 3 major stockholder firms, have advised investors to vote against the founder Vernon Hill due to a huge setback to the lender which occurred by an accounting error.

FTSE 100 concluded with a 0.5% fall or 37.74p at 7310.88p.

Tui was down by 6.4% or 53.2p settled at 775p.

Easyjet suffered a loss of 3.4% or 35p, at 990p.

Braemar Shipping, a marine firm, rose with a splash with an incline of 11.1% or 20p and closed the day at 200 points.

For the financial year’s ending on February 28,

- Losses slid down to £27.4 million as compared to £2.9 million of the previous year.

- Revenue increased by 14% to £117.9 million.

Wyg, an engineering advisory company, raked in after having accepted a merger bid from its US counterpart Tetra Tech. Finally the day ended with the Wyg’s closing per-share offer being more than 3 times its closing price. With 55p per share it shot up to 235.9% or 37.75p to a final 53.75p.